Introduction

Online Accounting Software is an essential tool for businesses of all sizes, helping manage finances, track expenses, and simplify reporting. However, businesses often face a dilemma: should they choose open source account software or go with proprietary account software? Each option offers distinct advantages and limitations, depending on your company’s size, budget, and technical expertise. In this blog, we will explore the pros and cons of open source and proprietary account software, guiding you to make the right choice for your business.

With the right financial management tools, companies can automate processes, reduce errors, and gain insights into their financial health. Let’s dive into the details to help you understand which type of Online Accounting Softwarebest suits your business.

1. Online Accounting Software: What is Open Source?

Open source account software refers to programs whose source code is freely accessible. Businesses can modify the software to meet specific needs, customize reports, or integrate additional features. Popular examples include Odoo Accounting, GnuCash, and FrontAccounting.

Pros of Open Source Online Accounting Software:

- Cost-effective or free: Many open source solutions are free or significantly cheaper than proprietary alternatives, making them ideal for startups or small businesses.

- High customization: Businesses can adapt the software to match unique accounting workflows or industry-specific requirements.

- Community support: Open source software often has a dedicated community of developers and users, providing forums, tutorials, and plugins.

Cons of Open Source Account Software:

- Requires technical expertise: Businesses may need in-house developers or IT support to implement and maintain the software.

- Limited official support: Unlike proprietary solutions, official customer support may be minimal or absent.

- Irregular updates: Updates and security patches may depend on community contributions, which can sometimes lead to inconsistencies.

2. Online Accounting Software: What is Proprietary?

Proprietary Online Accounting Software is developed by companies that retain full control over the source code. Users pay for licenses or subscriptions and rely on the vendor for support and updates. Common examples include QuickBooks, Xero, and Sage.

Pros of Proprietary Account Software:

- User-friendly interface: Proprietary solutions are designed for ease of use, even for non-technical staff.

- Regular updates and support: Vendors provide timely updates, security patches, and dedicated customer support.

- Secure and reliable: Proprietary software often adheres to industry standards, offering robust security features for sensitive financial data.

Cons of Proprietary

- Cost: Subscription fees or licenses can be expensive, particularly for growing businesses.

- Limited customization: Businesses may have fewer options to tailor the software to unique requirements.

- Vendor dependency: Companies rely on the vendor for updates, new features, and troubleshooting.

3. Key Differences Between Open Source and Proprietary

| Feature | Open Source | Proprietary |

|---|---|---|

| Cost | Low / Free | Paid / Subscription-based |

| Customization | High | Limited |

| Support | Community-based | Dedicated & professional |

| Updates | Irregular | Regular and automatic |

| Ease of Use | Requires technical skills | Beginner-friendly |

| Integration | Flexible with developer effort | Vendor-approved integrations |

Understanding these differences is essential when selecting business accounting solutions. Open source software offers flexibility and cost savings, while proprietary software provides reliability and convenience.

4. Which Online Accounting SoftwareShould You Choose?

The right choice depends on your business size, budget, and technical capability:

- Small businesses or startups: Open source account software is ideal if you have a tech-savvy team and want to reduce costs. It allows you to customize workflows and integrate additional features over time.

- Medium to large businesses: Proprietary account software is often a better fit for companies that need reliable support, scalability, and out-of-the-box features for complex financial processes.

By choosing the right account software features, businesses can automate invoice generation, track expenses, reconcile accounts, and generate financial reports efficiently.

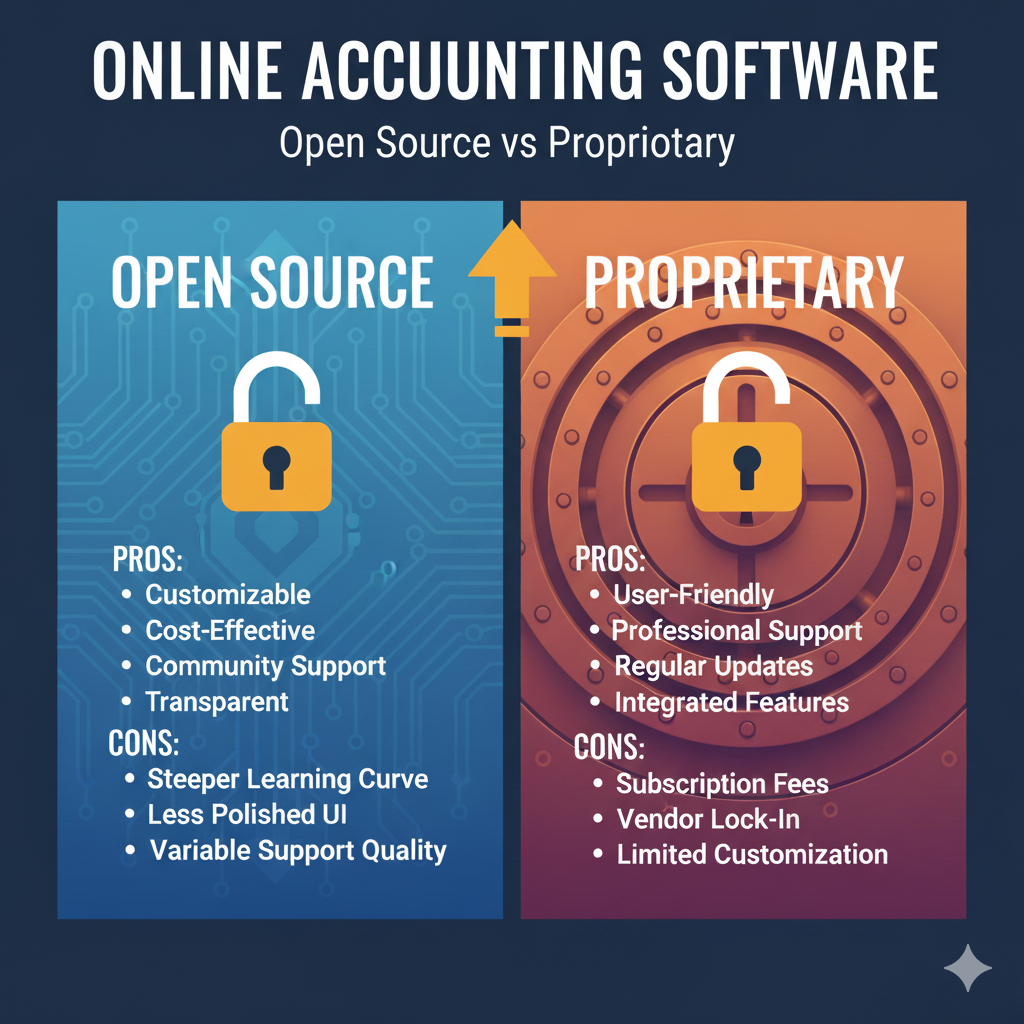

5. Pros and Cons Summary

Open Source Online Accounting Software:

- Pros: Cost-effective, customizable, community support

- Cons: Requires technical skills, limited official support, inconsistent updates

Proprietary Online Accounting Software:

- Pros: User-friendly, secure, regular updates, professional support

- Cons: Higher cost, less customization, vendor dependency

Conclusion

Both open source and proprietary have their unique advantages and challenges. Open source solutions are ideal for businesses seeking flexibility and cost savings, while proprietary solutions offer reliability, security, and professional support.

Ultimately, your decision should align with your business accounting goals, technical resources, and budget constraints. With the right choice of Online Accounting Software, you can streamline financial operations, reduce errors, and focus on growing your business with confidence.

TOP Accounting softwares IN DUBAI

Explore our range of smart accounting software designed to simplify financial management for businesses in Dubai, UAE. From invoicing and expense tracking to VAT compliance and real-time reporting, our solutions cater to startups, SMEs, and growing enterprises. Find the right tools to gain control over your finances, boost efficiency, and support business growth.

Sage 200 Evolution

Sage 200 Evolution is a powerful business management solution that goes beyond traditional accounting software. Designed to give you full control over operations, it integrates all core business functions into a single platform—providing actionable insights and driving efficiency across departments.

- Customizable modules for financials, inventory, CRM, and more.

- Real-time business intelligence and reporting tools.

- Scalable for growing businesses and industry-specific needs.

Tally ERP

Tally ERP is a trusted business management software ideal for small and medium enterprises. It offers a seamless solution to manage accounting, inventory, compliance, payroll, and more—all in one system built for simplicity and speed.

- Simplifies accounting, taxation, and financial reporting

- Supports multi-location inventory and business operations.

-

User-friendly interface with quick implementation and customization

QUICKBOOKS

QuickBooks is an intuitive accounting software tailored for startups and small businesses. It simplifies financial management with smart tools for invoicing, expense tracking, payroll, and real-time reporting—all in a user-friendly cloud platform.

- Easy-to-use interface with fast setup and navigation.

- Real-time insights for smarter financial decisions.

-

Cloud-based access for managing finances anytime, anywhere.

ZOHO BOOKS

Zoho Books is a smart cloud accounting platform built for modern businesses. It automates everyday tasks, streamlines financial operations, and ensures VAT compliance—making it ideal for growing companies in the UAE.

- Automates invoicing, payments, and tax calculations.

- VAT-compliant and tailored for UAE regulations.

-

Cloud-based collaboration with real-time updates.

SAGE 50 ACCOUNTS

Sage 50 Accounts is a trusted desktop accounting solution designed for small to medium-sized businesses. It offers powerful features to manage finances, control cash flow, and streamline day-to-day operations with accuracy and compliance.

- Robust tools for accounting, VAT, and payroll management.

- Real-time insights to track cash flow and financial health.

- Reliable desktop solution with cloud-connected options

XERO

Xero is a modern, cloud-based accounting software designed for small businesses and accountants. With real-time data, seamless bank integrations, and intuitive financial tools, Xero simplifies business finances from anywhere.

- Cloud access with live financial dashboards.

- Easy bank reconciliation and invoicing.

-

Secure, scalable, and built for collaboration.

The Future of Business Management

with Adept ERP

At Adept Business Solutions, we specialize in providing cutting-edge ERP and accounting software solutions designed to meet the unique needs of businesses in Dubai, UAE. With over 15 years of industry expertise, we are dedicated to empowering organizations with innovative tools and personalized support for sustainable success.

- Tailored Solutions for Your Business Needs

- Expert Guidance and Support

- Enhanced Operational Efficiency

BoOK YOUR DEMO !

To book your Product Demo please complete the form: